Insurance

(The Hyperscience advantage)

Pioneer the future of insurance with smarter, customer-centric automated processes

Accelerate claims processing

Automate data extraction and validation to reduce turnaround times and improve accuracy.

Optimize policy administration

Simplify complex workflows to minimize errors and enhance efficiency.

Strengthen risk and fraud management

Leverage advanced automation to detect fraud and ensure compliance while building trust with your customers.

Meet the Hyperscience Hypercell

99.5% accuracy

Extract policyholder and claims data

98% automation

Accelerate underwriting and claims

User-friendly

Simplified training and deployment

Scalable

Integrates seamlessly with insurance industry systems

Secure

Ensures compliance and data privacy

Creating harmony across your insurance ecosystem

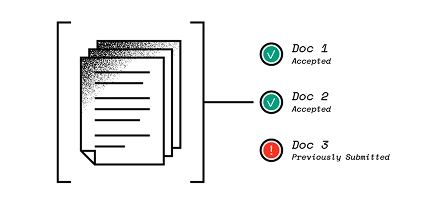

Hypercell is modular, scalable, and integrates effortlessly with your insurance systems like Guidewire, Duck Creek, and Vertafore AMS360

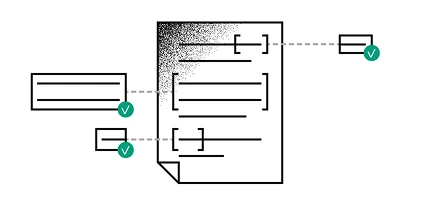

Built API-first, Hyperscience seamlessly integrates with your existing systems, ensuring smooth data flow and effortless compatibility with all downstream processes.

(Supported segments)

Faster insurance claims, smarter underwriting, and seamless policy management

Insurers face growing demands for speed, accuracy, and compliance while managing an overwhelming amount of paperwork. Hyperscience automates document-intensive processes across life, health, property, casualty, and reinsurance, ensuring policies are issued faster, claims are processed with greater accuracy, and risk assessments are more reliable.

Policy Issuance

Automating the creation, distribution, and storage of policy documents

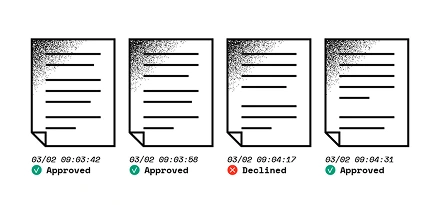

Claims Processing

Streamlining the collection, validation, and approval of claims

Underwriting

Automating data collection and risk assessment to expedite the underwriting process

Policy Issuance

Automating the creation, distribution, and storage of policy documents

Claims Processing

Streamlining the collection, validation, and approval of claims

Underwriting

Automating data collection and risk assessment to expedite the underwriting process

[Customer Success]

It’s allowed us to start processing documents like claim forms and invoices in 20% of the time that it took to do manually.

Supported document & process types

Beneficiary Designations

Certificate of Insurance

Claims Documentation

Claims Forms

Claims Sharing Agreements

Claims Submission Forms

Client Communication Records

Client Intake Forms

Commercial Policy Documents

Coverage Summaries

Damage Assessment Reports

Endorsements

Enrollment Forms

Explanation of Benefits (EOB) Statements

Financial Statements

Fraud Detection Alerts

Inspection Reports

Insurance Quotes

Medical Necessity Letters

Medical Records and Reports

Policy Applications

Policy Renewal Notices

Regulatory Compliance Reports

Regulatory Filings

Reinsurance Contracts

Renewal Notices

Risk Assessment Reports

Underwriting Reports

(Start building today)

Get started

Take the next step with Hyperscience to future-proof your operations with trusted, accurate data.